There are different kinds of taxes in Canada. You will pay taxes when you buy items at stores. This is called sales tax. You will also pay taxes when you make money. This is called income tax.

You may have to pay business taxes and property taxes depending on where you work and live.

The Canada Revenue Agency (CRA) handles taxes in Canada.

Sales tax

Most things you buy in Ontario are subject to the Harmonized Sales Tax (HST). HST is added to your bill when you pay. HST is calculated at 13 per cent of the total of your sale.

Certain items, like fresh produce and grocery store items may be exempt from HST. Other items like children’s clothes, car seats and feminine hygiene products may have reduced sales tax.

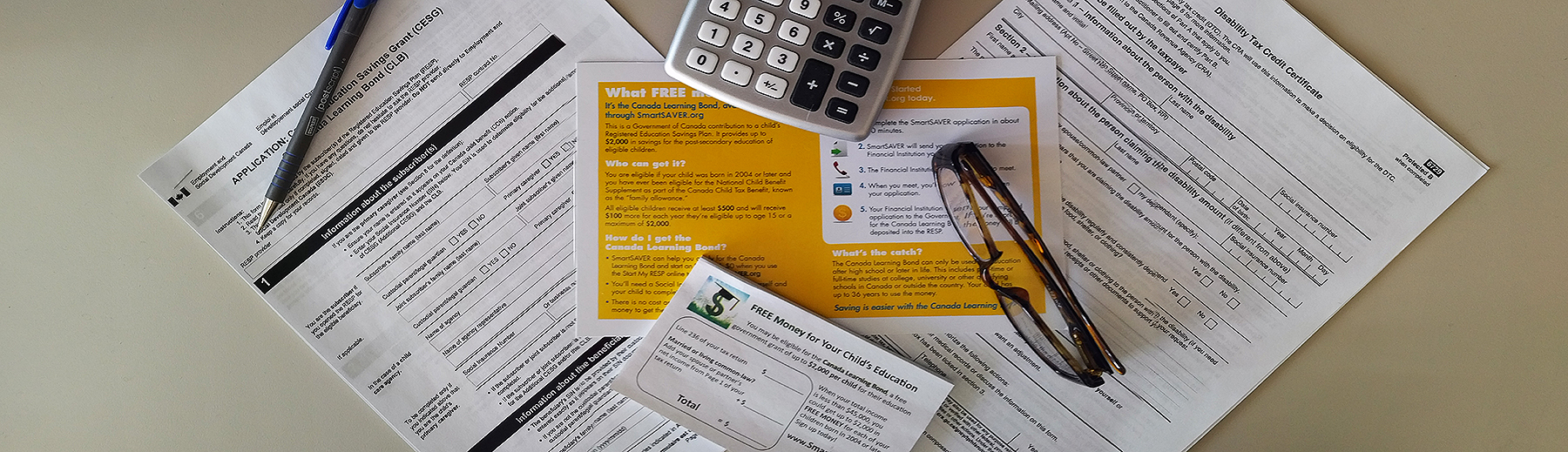

Personal income tax

You will need to file your personal income tax with CRA every year.

Filing your taxes

When you calculate, submit and pay your taxes, this is known as filing your taxes.

You can file your taxes yourself online using a software program or hire someone to help you. If you are doing your taxes yourself, make sure that you understand how to fill out each form to avoid any issues with CRA.

Free income tax clinics are available year-round in Durham Region and during tax season, many libraries, the Welcome Centres and some Region of Durham offices also offer income tax clinics. Volunteers at the income tax clinic will help you to file your income tax return. In Ontario, there are 41 income benefit programs accessed directly or indirectly through filing your tax return. Volunteers at the income tax clinics can help you to access these.

Tax Filing Resources

Register for a free webinar at Upcoming events - Canada.ca.

Missed a webinar or can’t make the broadcast? Past webinar recordings are posted on Outreach materials to print and share - Canada.ca. Past webinar topics have included scam awareness, the disability tax credit, and more.

Learn about your taxes is an online learning tool to help people understand how the Canadian tax system works. This resource seeks to demystify taxes, empowering individuals by teaching them how to do their personal taxes, and to increase awareness of available benefits and credits.

Resources in a Variety of Languages

|

Video - Benefits and Credits for Newcomers to Canada (3 mins) |

Available in Arabic, Cantonese, English, Farsi, French, Hindi, Mandarin, Punjabi, Russian, Spanish, Tagalog, Ukrainian, and Urdu. |

|

Factsheet - Newcomer benefits and credits |

Available in Arabic, Dari, English, French, Pashto, Punjabi, Russian, Simplified Chinese, Spanish, and Ukrainian. |

|

Factsheet - Canada Dental Benefit

|

Available in Arabic, English, French, Simplified and Traditional Chinese, Hindi, Punjabi, Spanish, Tagalog, and Ukrainian. |

|

Factsheet, poster, and postcard - One-Time Top-Up to the Canada Housing Benefit |

Available in Arabic, Cantonese, English, French, Hindi, Mandarin, Punjabi, Spanish, Tagalog, Ukrainian, and Urdu. |

|

Infographic - Newcomer benefits and credits

|

Available in Arabic, Dari, English, French, Pashto, Punjabi, Russian, Simplified Chinese, Spanish, and Ukrainian. |

|

Posters - Scam awareness

|

Available in Spanish, English, Farsi, French, Simplified Chinese, Traditional Chinese, Arabic, Tagalog, Punjabi, Ukrainian, and Russian. |

|

Resources for tax-filing season *Coming soon* Tax tips for newcomers in a variety of languages

|

Property taxes

You will need to pay property taxes if you own your home.

Property taxes and methods of payment in Durham Region may vary between the different local area municipalities.

There are options for how to pay your property taxes. One of the popular options is to have your property tax added and divided into your mortgage payments.

Taxes for business

There are different taxes for business owners. Find out how business taxes can affect you if you own a business here.

Tax credits

See if you are eligible for tax credits for yourself, your family, tuition or your business.

Contact Us